Revolutionizing Financial Services Procurement

End 2 End service innovation reduces resources by approx. 30%

The problem

The financial platform of Danske Bank for businesses and corporates—District—after its initial launch, needed to amplify its offering and integrate external partners to address broader customer pain points, while creating new revenue streams. The vision was to develop a marketplace in the platform, digitalising the procurement of financial services.

Role: Principal Service & UX Designer

Team: Evangelos, Thomas, Morten, Mille

Year: 2018-2020

Tasks: Customer research, Insights Generation, Service Design, UX Design, Prototyping, Process optimisation, Scenario Building & Storytelling, Workshop facilitation, MVP definition

Results & Impact

Designed an end-to-end procurement service and customer-facing digital touchpoints for purchasing and management.

30%

2

reduction in resources

Months for MVP launch

2

external partners integrated in 1st quarter

Key moments - trade offs

Debunking the Fully Digital Marketplace Belief.

Creating a marketplace for financial services had full self-service aspirations, but this went against what sales and account managers were experiencing. I designed and ran customer interviews with different business customer types, generating 5 core insights that offered clarity and adjusted expectations, effectively managing stakeholders.

Primary Insights from customer interviews

Communicating the Scope of Strategic Shift

While the need for digitalizing procurement was accepted, the shift required from existing to future service was unknown. I conducted journey mapping exercises with internal experts to visualize the current and future situations—leveraging research findings and team brainstorming—and built a narrative using storyboarding to communicate the scope with clarity.

Future Service Blueprint

Experience storyboarding outlining inteactions

AS IS Service Blueprint

Balancing Speed and Scalability

The marketplace experience was the next scaling step for the corporate platform, creating pressure to move quickly while foundational elements like systems and processes took longer to change. I designed an MVP version with semi-manual execution leveraging existing financial services, allowing for quick experimentation and customer feedback loops while modernizing internal processes and systems.

Marketplace homepage iterations. From early explorations to final version for MVP

Onboarding and Converting Customers

Research showed customers didn't purchase financial services like shopping on Amazon, with concerns about trusting the bank's suggestions and the desire to learn before purchasing. To address this, I designed a modular product detail page that scaled based on the product offered, pricing model, and purchase options (trial/no trial), building trust and enabling informed decisions.

Architecture of the detail page to fit various needs

Digitalizing Complex Customer Processes

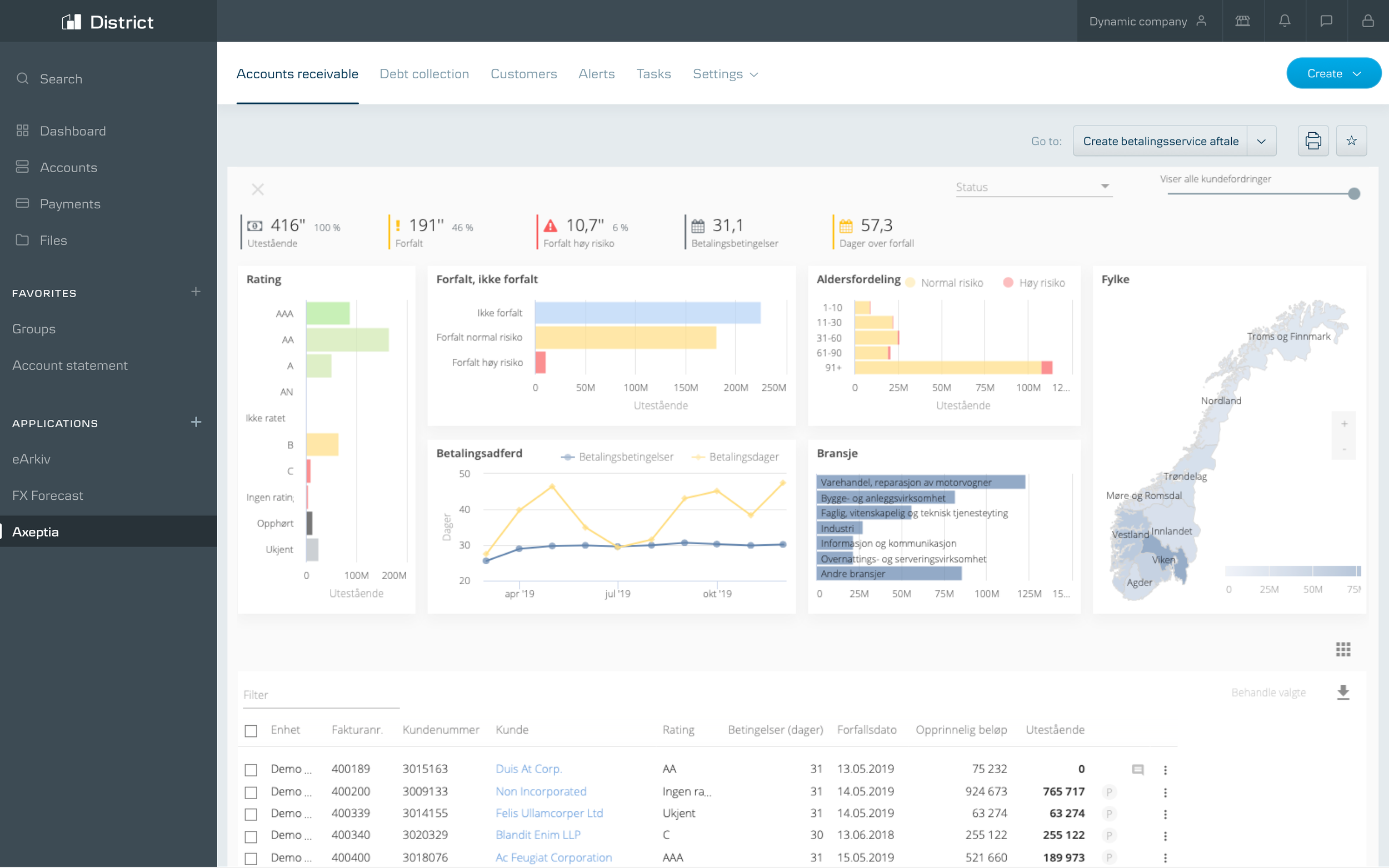

Different customer types had different internal processes for purchasing services, requiring our management interface to be customizable without feature overload. To maintain simplicity and scalability, I applied platform-wide experience patterns and enhanced our design system where needed, without limiting design needs for specialized interactions like purchase approvals and cart.

Flow Diagram of Ordering and Approving the purchase of a service

Order management dashboard - user

Placing an Order

Integrating External partners into the Experience Framework

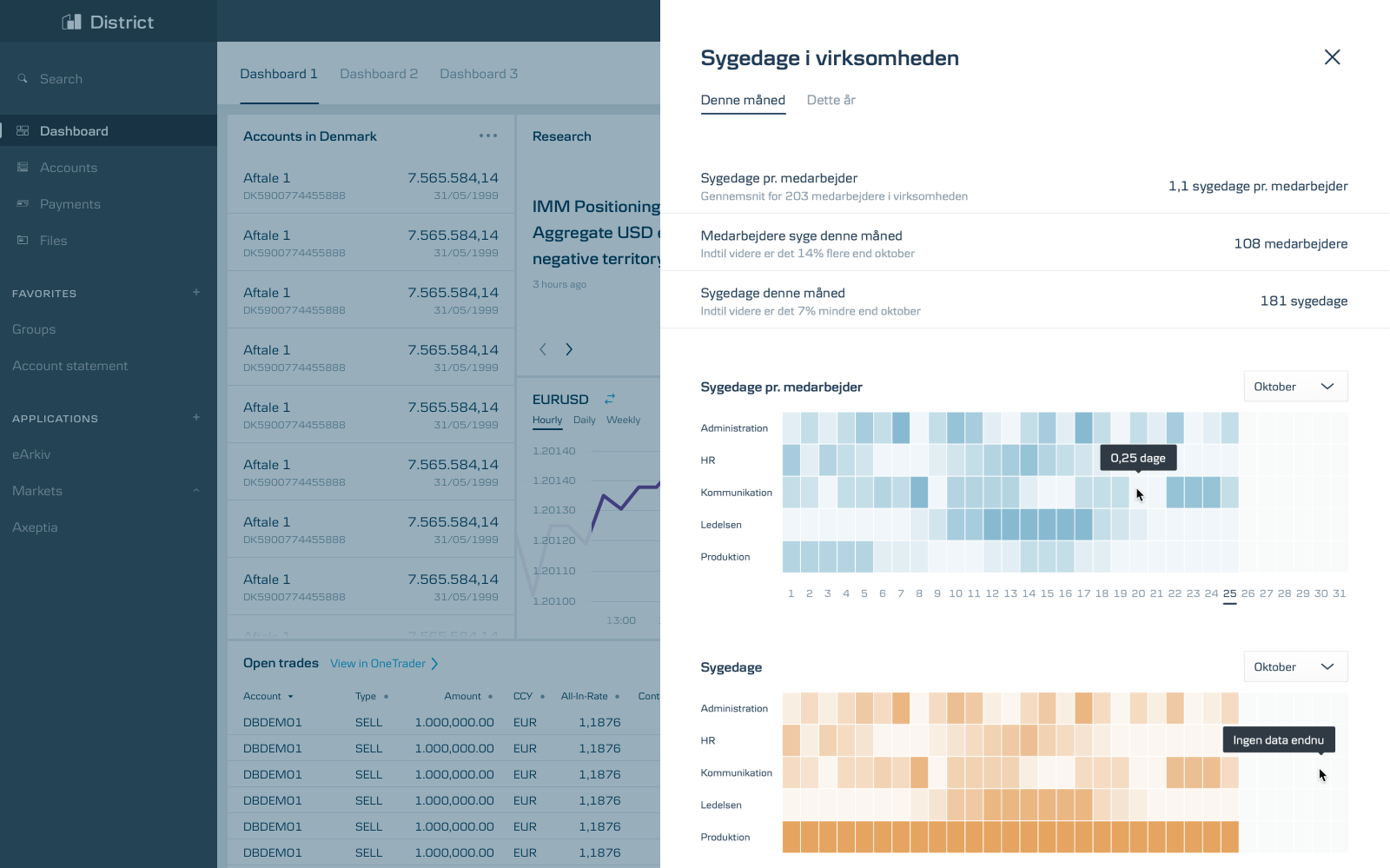

During the 1st quarter we tested the selling and integration of external applications from trusted providers in the Marketplace. This created a challenge to incorporate different types of User experience within our own Experience Framework, with the danger of undermining customer satisfaction. I worked as a designer-product owner with the external partners and created a step by step engagement process starting with analysis, modification proposal, assessment and refinement and implementation. This created clarity on what was possible and assured minimum standards of UX quality.

Integration of extrenal application leveraging the XP framework

Panel view of an External provider’s widget after modifications

Learnings

Need for Transparency of the Landscape: To gain momentum and support from senior stakeholders for end-to-end service innovation, deep understanding of the current situation must be in place along with clear visualization of the future.

Small Steps as a Lever to Manage Complexity: When innovation scope is complex and multi-faceted, long-term investment comes in smaller pieces that can be gradually built and deliver incremental customer value throughout the project duration.