Scaling the financial platform for corporates and businesses

Player-coach leadership boosts CSAT score to >80% after 9 months of platform migration

The problem

Danske Bank set a goal to revolutionize how businesses run from small business owners, accountants, to bookkeepers and CFOs. The legacy business platform running for 15+ years wasn't suited to serve 300,000+ customers across 8 countries. Corporate Banking had launched District as the new platform, developed as a SaaS model with new technologies and experiences, which was now entering its scaling phase.

Role: Player-Coach Leader—Service/UX Design, Team Management

Team: Evangelos, Morten, Jeppe, Laerke, Mikkel

Year: 2018-2020

Skills: Product Design, UX, Information architecture, Team Leadership, Interaction design, UX strategy, Product vision, Customer research, Stakeholder management

Results & Impact

Player-coach leadership of the end-to-end digital financial service and experience strategy. 7 new experiences and the bank's first design system were launched.

80%

1

Experience Framework adopted Bank wide

Legacy embeded applications

CSAT score

10+

Key moments - trade offs

Legacy vs New Experience

District needed to embed legacy applications not yet migrated to its technology and experience, while offering a complete product to customers. This influences negatively customer engagement and CSAT score, requiring improved experience. I led the design direction of an improved experience and navigation framework that wrapped legacy applications, allowing a cohesive user experience and seamless future migration. Additionally, I drove the strategy and governance of the design system using design tokens, which became the base of the bank's wide system.

Initial Navigation experience

New Navigation framework

Legacy applications the old experience framework

Legacy applications the new experience framework

Component Page

Themes based on design tokens

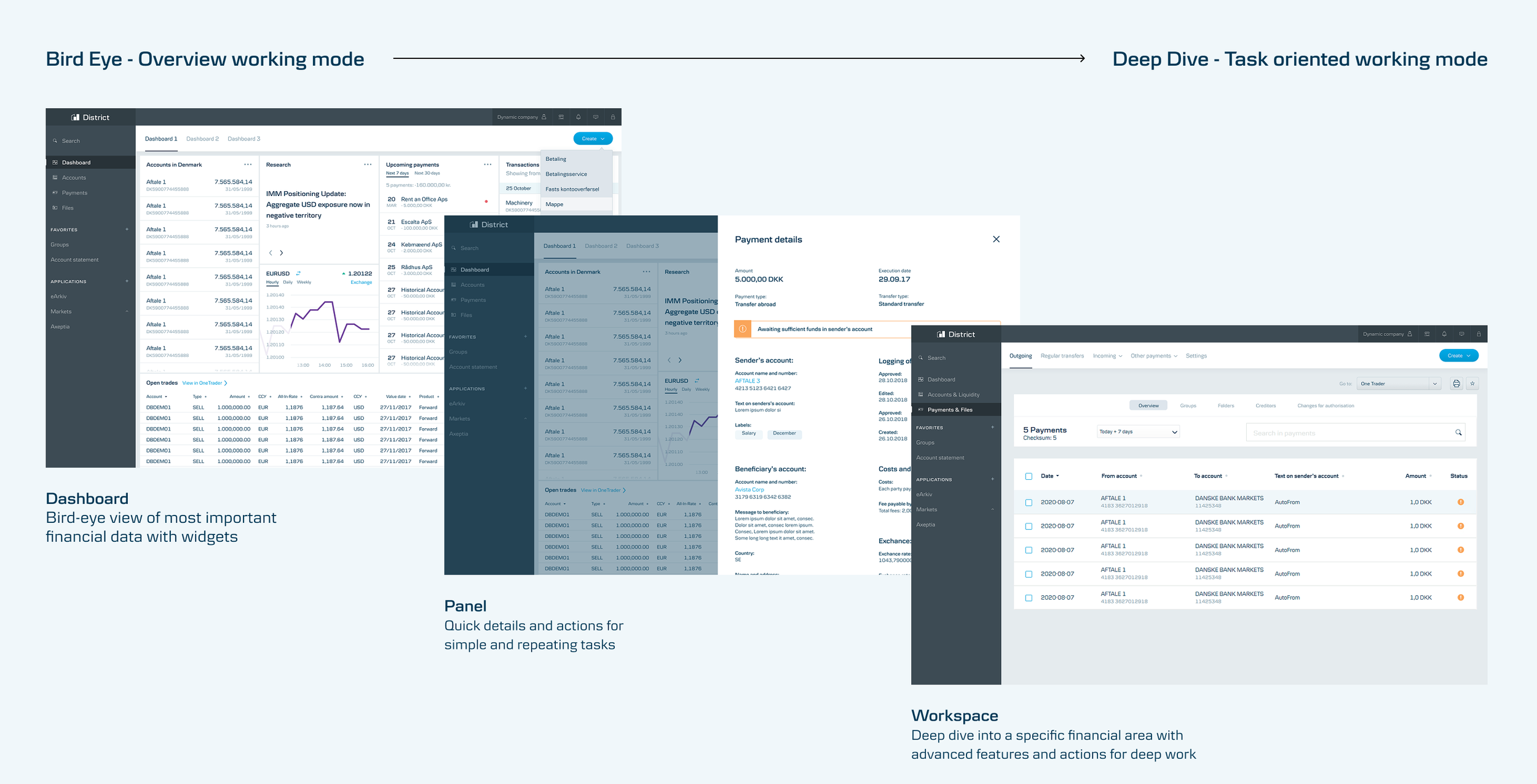

Balancing Conflicting Modes of Work

District had to cater to customers from the one-person business owner to professional accountant and CFO, requiring different modalities and content depth that could complicate the experience. I defined the different variables influencing working modes for customers and used that to amplify existing patterns (dashboard, panel, full-screen workspace) with rules of usage, creating fluidity in transitions.

Experience from Bird-eye to Deep dive modes

Simplifying the Onboarding Experience

District had a learning curve for customers migrating from the legacy experience, and we needed to streamline the welcoming experience and support customer training, which otherwise was done by colleagues or bank advisors. The UX team partnered with Marketing to develop a series of onboarding videos promoting the unboxing feeling when accessing District for the first time, and offering walkthroughs of main features to supporting different training styles for different users.

Unboxing Video

Introduction to the Platform

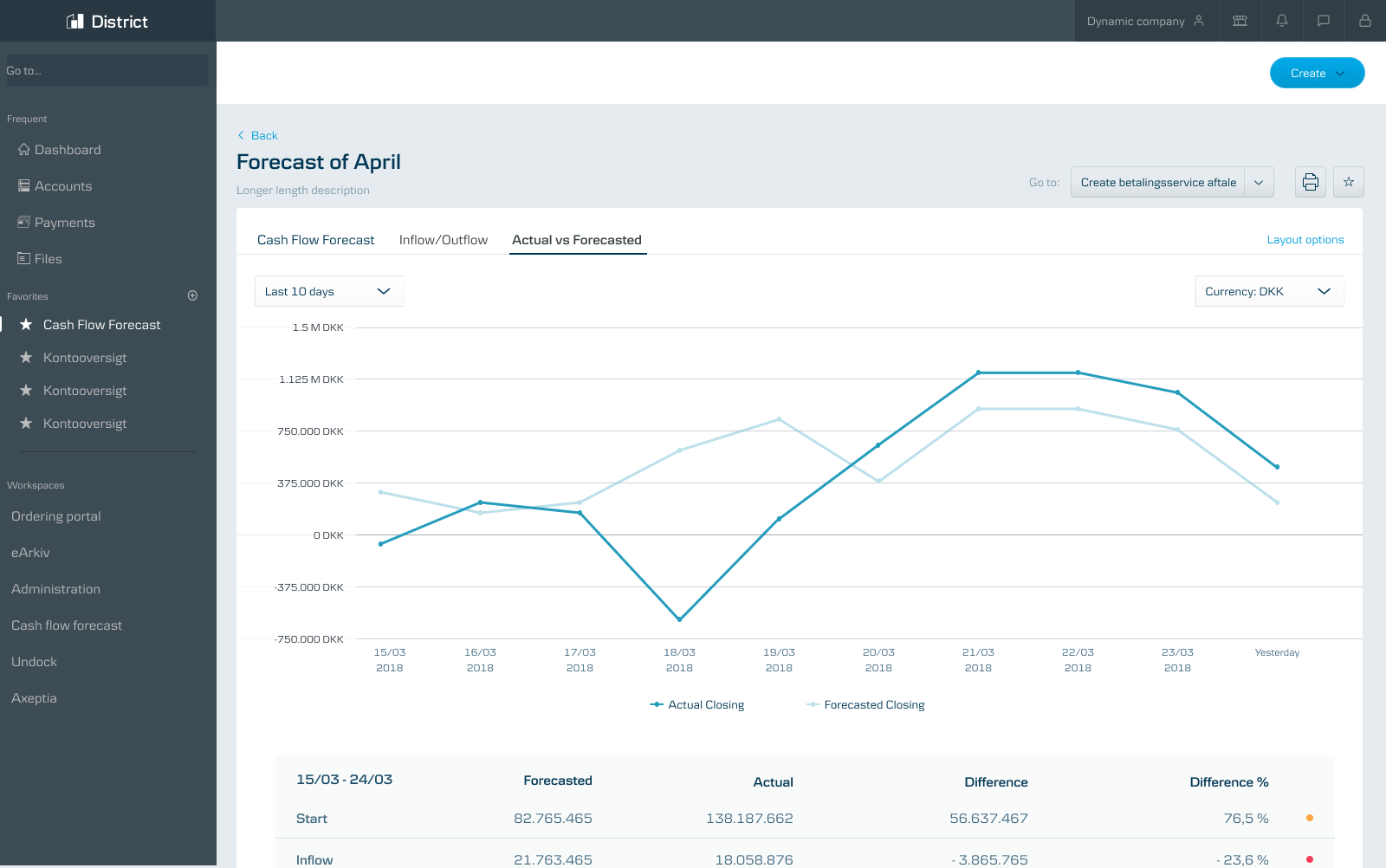

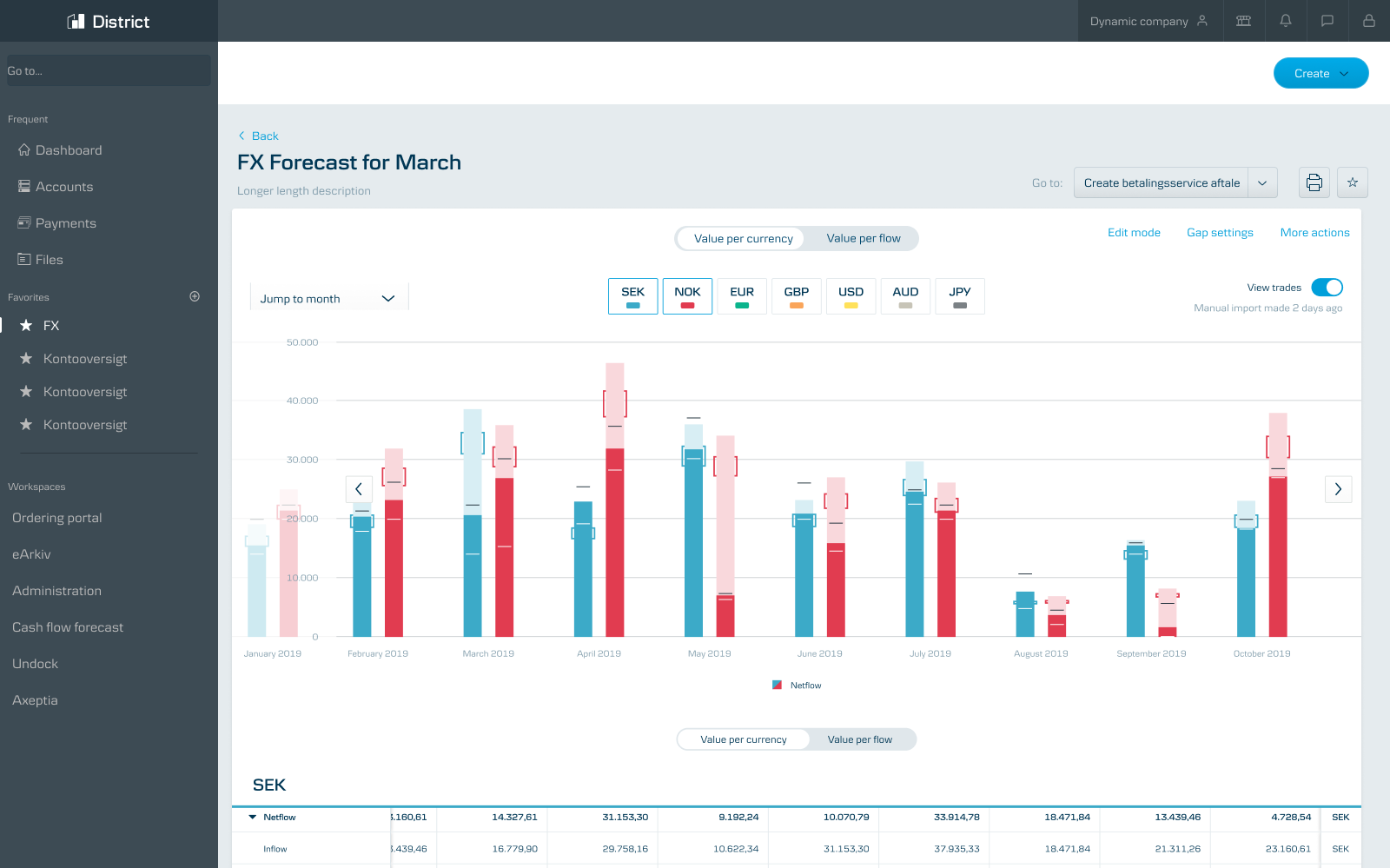

Simplifying Complex Finance Products

Corporate banking includes complex core services like Payments, FX, and Cash Flow that needed simplification while balancing core business needs. With player-coach leadership, I helped the team mentor business managers in design thinking and deliver robust and intuitive applications leveraging the District experience framework.

Cash Flow Forecast application

FX Hedging Application

Team Growth and Engagement

District had a variety of design challenges for the UX team to deliver impact on, but we faced complications like siloed and repetitive work for part of the team, needing clear growth paths. With a player-coach leadership approach, I assigned ownership of different platform design aspects and team initiatives to individual designers. I created broader team vision through collective collaboration, providing concrete growth paths and enabling innovation without compromising platform experience.

Learnings

Translating Misaligned Visions: When business and technology have different visions for direction and roadmap, as a design leader it's required to remove the noise with clear messaging translating both worlds, enabling the team with clear objectives.

Clear Experience Vision Engages the Team: Leading design of complex platforms requires putting work on a cohesive experience vision together with your team, giving them solid foundations in individual work, ownership and space to innovate without compromising platform experience.

District it is still evolving product of the Bank and serving more than half million business customers across the nordics. Learn more about District